EXTRACTING BENEFITS FROM NATURAL RESOURCE EXPLORATION & EXPLOITATION: A CHANCE FOR LOCAL COMMUNITIES TO DIG DEEP INTO BENEFIT SHARING

Natural resources are finite and non-renewable, aspects which require maximisation of their benefits balanced with the need to attract and retain exploration capital necessary to sustain such benefits for as long as possible. It is for this reason that the Constitution of Kenya mandates Parliament to enact legislation on the exploitation of natural resources. Kenya’s Senate is currently tasked with debating the Natural Resources (Benefit Sharing) Bill, 2014 (“the Bill”) sponsored by the Chair of the Senate Select Committee on Legislation on Royalties, Senator Agnes Zani.

The Bill seeks to establish a system of benefit sharing in resource exploitation between natural resource exploiters, the national government, county governments and local communities. Indeed, the nascent oil and gas, mining and natural resources sector in Kenya has necessitated a concise and progressive approach to benefit sharing so as to reallocate royalties from these sectors to support local infrastructure development and help mitigate the negative social and environmental impact from the budding industry. The overall impression of the proposed law reflects a growing trend towards ensuring that benefit sharing feeds into broader development outcomes for local host communities. It is therefore expected that the extractive industry will deliver sustainable benefits to local and national stakeholders should the proposed law be enacted.

Natural Resources Benefit Sharing in Perspective:

Benefit Sharing commitments as far as natural resources are concerned, are captured through mutually negotiated agreements based on a consultation process on proposed natural resource extraction with the potential of impacting the rights of the local host community. They generally include revenue sharing, project support, social and environmental impact and development terms, etc., including residual benefits from infrastructural and industrial developments arising out of natural resource extraction and exploitation projects. These agreements aim to address historical and emerging infrastructure deficits resulting from the vast majority of natural resources being located in the rural and remote areas which have been or are at risk of being economically and socially marginalised.

A broad overview of the proposed law:

Scope & Application:

The proposed law covers exploitation of petroleum, natural gas, minerals, forest resources, water resources, wildlife resources and fishery resources, subject to extension to other natural resources by a Benefit Sharing Authority which is to be established and whose functions will include:

a) to coordinate the preparation of benefit sharing agreements between local communities and organisations involved in the exploitation of natural resources (affected organisations);

b) to review and determine royalties payable by affected organisations;

c) to identify counties that require to enter into benefit sharing agreements;

d) to oversee the administration of funds set aside for community projects identified or determined under a benefit sharing agreement;

e) to monitor compliance with the law and the implementation of any benefit sharing agreement;

f) to conduct research regarding the exploitation and development of natural resources and benefit sharing in Kenya;

g) to make recommendations to the national government and county governments on the better exploitation of natural resources in Kenya;

h) to determine appeals arising out of conflicts regarding the preparation and implementation of county benefit sharing agreements; and

i) to advise the national government on policy and the enactment of legislation relating to benefit sharing in resource exploitation.

Guiding principles of benefit sharing:

The Bill sets out the following as guiding principles of benefit sharing which are intended to influence the application of the proposed law:

a) transparency and inclusivity;

b) revenue maximisation and adequacy;

c) efficiency and equity;

d) accountability and participation of the people; and

e) rule of law and respect for human rights.

Determination & Review of Royalties and Fees:

The Benefit Sharing Authority (the Authority) to be established under the proposed law is mandated to determine and review royalties and fees to be paid by affected organisations, taking into account the following considerations:

a) the overall capital investment of the affected organisation;

b) the prevailing international market value of the commodity from which royalty is payable;

c) the commercial viability of the natural resource being exploited; and

d) any existing County Benefit Sharing Agreement with the local community.

However, the proposed law goes further to prescribe that where a written law prescribes the royalty, fees, payments or benefit sharing in a particular natural resource sector, the relevant written law shall apply to that sector. This provision seems to imply that existing laws on royalty payments and benefit sharing in particular sectors take precedence over the proposed law.

Collection of Royalties:

The Kenya Revenue Authority (KRA) is mandated under the proposed law to collect royalties imposed by the Authority and any other payment of royalties from natural resource exploitation undertaken under any written law. The monies collected are to be deposited into the Natural Resources Royalties and Fees Fund to be established under the proposed law. KRA is also required to declare and account to the Authority all sums collected from affected organisations with respect to natural resources. This will increase compliance costs in terms of reporting requirements for organisations in the extractive sector so as to avoid revocation of their operating licences.

Natural Resources Royalties Fund:

The Bill proposes the establishment of a Natural Resources Royalties Fund which shall vest in the Benefits Sharing Authority. The Fund shall comprise of:-

a) all royalties collected as a result of exploitation of natural resources in the country;

b) all fees and other charges levied on affected organisations for the exploitation of natural resources; and

c) all contributions and other payments required to be paid into the Fund.

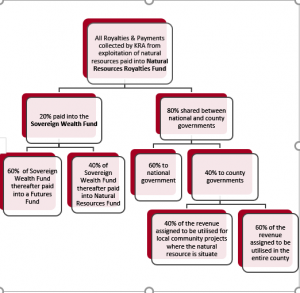

Revenue Sharing Ratio:

The revenue sharing ratio proposed under the Bill is as follows:

1. 20% of the revenue collected by KRA (royalties and other fees charged for the exploitation of natural resources) shall be paid into a Sovereign Wealth Fund to be established by the national government for the benefit of future generations. The amount paid into the Sovereign Wealth Fund shall thereafter be paid into the following funds constituting the Sovereign Wealth Fund as follows:

a) 60% into a Futures Fund; and

b) 40% into a Natural Resources Fund.

2. The remaining 80% of the revenue collected shall be shared between the national government and the county governments in the ratio of 60% to the national government and 40% to the county governments. Moreover, at least 40% of the revenue assigned to the county governments is to be utilised for local community projects with 60% being utilised in the entire county.

Where a natural resource spans over two or more counties, the Authority will determine the ratio of sharing the retained revenue amongst the affected counties, due consideration having been taken of the following:

a) the contribution of each affected county in relation to the resource;

b) the inconvenience caused to the county in the exploitation of the natural resource; and

c) any existing benefit sharing agreement with an affected organisation.

The Authority is also mandated to review the revenue sharing ratio after every five years with recommendations for Parliamentary approval.

The proposed law therefore proposes the establishment of two (2) Funds in respect of royalties and other fees levied on organisations for the exploitation of natural resources as follows:

The resultant retained revenue sharing ratio under the proposed law is will therefore be follows:

- Sovereign Wealth Fund: 20%

- National Government: 48%

- County Government: 19.2%

- Local Communities: 12.8%

Benefit Sharing Agreements:

With regard to Benefit Sharing Agreements, the Bill proposes that every affected organisation shall enter into such agreements with the respective county government known as “County Benefit Sharing Agreements”. These agreements will include non-monetary benefits that may accrue to the county and the contribution of the affected organisation in realising the same. This provision is in line with governance and best practice trends in the extractive sector, which demand greater corporate social responsibility initiatives by concerned organisations.

Further, each county with a natural resource shall have a County Benefit Sharing Committee whose mandate is to:-

a) negotiate with affected organisations on behalf of the county government prior to entering into a county benefit sharing agreement;

b) monitor the implementation of projects required to be undertaken in the county pursuant to a benefit sharing agreement;

c) determine the amount of money to be allocated to each local community from sums devolved under the proposed law;

d) convene public forums to facilitate public participation with regard to proposed county benefit sharing agreements prior to execution by the county government in line with constitutional requirements for public participation in management of natural resources;

e) convene public forums to facilitate public participation on proposed community projects to be undertaken using monies that accrue to a county government under the proposed law; and

f) make recommendations to the county government on projects to be funded using monies which accrue to the county government.

Where a resource spans over two or more counties, the affected counties are required to constitute a joint committee to oversee the negotiation of a joint county benefit sharing agreement with an affected organisation.

The Bill also proposes the establishment of a Local Benefit Sharing Forum in each affected local community. This Forum shall be comprised of five (5) persons elected by the residents of the local community and whose functions shall be to:

a) negotiate with the county benefit sharing committee for the purposes of entering into a local community benefit sharing agreement on behalf of the community;

b) identify local community projects to be supported by money allocated to the local community by the county benefit sharing committee; and

c) oversee the implementation of projects undertaken at the local community using funds devolved under the Act.

Additionally, every affected local community is required to enter into a local community benefit sharing agreement with the respective county benefit sharing committee. These agreements must include non-monetary benefits that may accrue to the local community and the contribution of the affected organisation in realising the same.

Ratification of Benefit Sharing Agreements:

The proposed law further requires every county benefit sharing agreement to be approved by the County Assembly of the respective county prior to execution by the county government. Each county and local community benefit sharing agreement negotiated and executed will also require to be deposited with the Benefit Sharing Authority and a copy submitted to the Senate. This requirement seems to give effect to Article 71 of the Constitution of Kenya which stipulates that agreements relating to the grant of rights or concessions for the exploitation of natural resources are subject to ratification by Parliament.

Reporting Requirements:

The Bill imposes certain reporting obligations on the Benefit Sharing Authority which shall be required to submit an annual report to the President and the Senate detailing the following:

a) its financial statements;

b) a list of institutions contributing to benefit sharing;

c) the proportion of benefit and the local community that benefitted;

d) the total sums contributed towards benefit sharing and its distribution; and

e) the progress made in the implementation of the Authority’s functions.

This annual report shall also be published in the Gazette and in at least one newspaper of national circulation. This provision seems to be intended to enhance accountability and transparency in natural resource revenue management.

Offences:

Failure to furnish particulars or information required to be furnished to the Authority or the making of false statements is an offence rendering the organisation liable to a fine of not less than 5 million shillings. In addition, every principal officer is liable to imprisonment for a period of 3 years or a fine of not less than 2 million shillings or to both such fine and imprisonment. Continuous breach of the proposed law by an affected organisation is likely to lead to cancellation of its operating licence(s). This provision ought to be read in conjunction with the provisions of the Mining Bill, 2014 which prescribe penalties for offences relating to monitoring and inspection of records.

Transition:

The Authority is mandated to review all existing laws and agreements prescribing the ratio of natural resource sharing within one (1) year of being constituted, taking into account best practice in revenue sharing. Upon carrying out such review, the Authority is required to submit a report to the National Assembly and the Senate and the Cabinet Secretary responsible for natural resources within three months of concluding the review. This report shall also set out proposals on legislative and policy amendments requried to fully implement the proposed law. The review of natural resource sharing ratios within one (1) year of the establishment of the Benefit Sharing Authority may require affected organisations to review existing benefit sharing agreements with a view to aligning them to revised ratios, which is likely to create uncertainty for investors in the extractive sector.

Discretionary powers:

The Cabinet Secretary responsible for for natural resources is granted the powers to make regulations for the better carrying out of the provisions of the proposed law including the following:

a) prescribing the procedure for the nomination of representatives from the Council of Governers and the Forum of County Assembly Speakers as members of the Authority;

b) prescribing and reviewing the revenue sharing formula under the proposed law;

c) prescribing the fees in respect of anything required to be done under the proposed law;

d) prescribing the administration of the Fund;

e) prescribing the mode for the payment of royalties; and

f) prescribing the revenue sharing formula between counties that share a natural resource.

Commentary:

The proposed law is a positive step as far as benefit sharing is concerned, as it addresses the need for good corporate governance and best practice in the natural resources sector, and devolves decision making, implementation and enforcement mechanisms. It also meets the constitutional requirement for public participation in the management of natural resources. The Bill further seeks to apply the broad principles of taxation such as equity in the determination and review of royalties and fees payable by affected organisations, with due consideration of commodity price volatility, inflation, consumption and trade imbalances.

Nonetheless, whereas the potential benefits accruing to the local communities are numerous, along with these benefits come several challenges such as how the Natural Resources Royalties Fund and the Sovereign Wealth Fund will be administered, how to monitor the progress of benefit sharing arrangements, how to balance future investment under the Sovereign Wealth Fund with short-term gains as well as how to facilitate collaboration between different counties and communities, given the boundary and administrative challenges currently being experienced by county governments.

As much as the Bill is a progressive attempt by Kenya to address inequities in natural resource exploitation, the proposed law has not identified how the benefits to be shared will balance with costs incurred by investors. Moreover, it is unclear how legitimate beneficiaries will be identified, particularly where extraction and exploitation occurs on property whose legal ownership is in dispute, as recently witnessed by the boundary disputes between a number of counties.

The proposed law does not also address how costs and benefits can be redistributed through financing and ownership arrangements. Indeed, benefit sharing takes many forms including local ownership as set out in the Mining (Local Equity Participation) Regulations which require local equity participation of at least 35%. There is therefore need to align the proposed law with existing laws and regulations.

In addition, whereas the Bill sets out the prevailing international market value of the commodity, the commercial viability of the natural resource being exploited and the overall capital investment are some of the key considerations when determining the royalties and fees payable, it does not address the element of differentiating the revenue sharing ratios based on the size, profitability and ability to pay of different natural resource exploration and exploitation projects at different levels and stages (i.e., discovery, exploration, development and commercialisation).

Despite the requirement for the Benefit Sharing Authority to consider existing agreements with local communities before determining and reviewing the royalties and fees payable by affected organisations, this is likely to create uncertainty in the sector. This is because the proposed law has not set out clear processes, timing and triggers for possible future review of royalty rates. Perhaps subsidiary legislation on the same will set out mechanisms for gradual review of royalties and rates so as to give stakeholders in the sector a chance to progressively adjust to their impact while avoiding retrospective application of revised royalty payments which acts as a disincentive to investors in the sector.

It is also noteworthy that whereas implementation of the proposed law necessitates a framework with scope for administrative discretion, such discretion ought to be tempered so as to avoid undesirable precedents and inequities associated with unfettered discretion as far as the administration of the Natural Resource Royalties Fund and review of the revenue sharing formula are concerned.

Conclusion:

It remains to be seen how the proposed law, if enacted, will impact on existing laws and regulations in the natural resources and extractive sectors, such as the Ninth Schedule of the Income Tax Act, the Mining (Local Equity Participation) Regulations, the Petroleum (Exploration & Production) Act and the proposed Mining Bill, 2014. In order for benefit sharing laws to achieve their intended purposes, there must be an integrated approach which takes cognizance of Kenya’s current laws including legislation on land regarding the exploitation of land based natural resources, compensation for expropriation of land rights, conservation and sustainable management of these resources.

A critical consideration is that natural resource exploration and extraction is generally carried out by private companies which are largely exposed to significant risks that flow from the intensive capital investment required, the long exploration and pre-production periods during which no revenue is generated and the long life of extraction projects as well as the volatility of commodity markets and other uncertainties inherent in the extractive sector. Nonetheless, this sector has the capacity to generate significant revenue in excess of all the costs of production. The practical concern is for the government to design a legal regime that best meets its objective of tapping into the revenue flowing from this sector. It is therefore in the best interests of Kenya to adopt a collaborative approach that will create an enabling environment for effective benefit sharing without hampering investment in the extractive sector.

The Bill has only undergone the First Reading. We shall be monitoring any developments and keep you updated.

NB: The contents of this e-newsletter are for general information purposes only and do not constitute legal advice/legal opinion nor are they intended to create any client-lawyer relationship between the sender and the recipient. As legal advice must be tailored to the specific circumstances of each case, nothing provided herein should be used as a substitute for advice of a competent advocate. No reliance should therefore be placed on any information contained herein without first seeking the advice of an advocate.

For consultation on this subject, kindly contact:

Stella Murugi

Senior Partner, Corporate & Commercial Law

Mwale & Company Advocates